Trading Nifty and FinNifty options at expiry have become widely popular, especially among experienced traders. And if you are an options trader or curious about options trading, you have probably heard about Nifty and FinNifty trading expiry dates.

Expiry-day Nifty or FinNifty trading is a high-risk, high-gain kind of strategy. The possibility of earning a significant profit is why most options traders are involved in expiry-day trading. Also, you can get help from a professional options strategy builder to trade at the expiry.

However, you must remember that expiry-day trading involves higher risks than usual. And you can only obtain the maximum profit and avoid significant loss if you strategize your move wisely. So, keep reading if you want to trade Nifty and FinNifty at expiry. Here, we will explore ways to trade Nifty and FinNifty at expiry without facing a significant loss.

Expiry-day Nifty or FinNifty trading is a high-risk, high-gain kind of strategy. The possibility of earning a significant profit is why most options traders are involved in expiry-day trading. Also, you can get help from a professional options strategy builder to trade at the expiry.

However, you must remember that expiry-day trading involves higher risks than usual. And you can only obtain the maximum profit and avoid significant loss if you strategize your move wisely. So, keep reading if you want to trade Nifty and FinNifty at expiry. Here, we will explore ways to trade Nifty and FinNifty at expiry without facing a significant loss.

Understanding the Expiry Day Strategy

Today you can efficiently perform expiry day Nifty or FinNifty trading with an options Algo trading app. First, however, you must learn about the expiry day strategy for Nifty and FinNifty before performing the trade. And before we discuss the details about how to trade Nifty and FinNifty at expiry, let us briefly discuss the expiry day strategies.

Expiry day-specific strategy is a type of strategy that is performed on the day when the options derivatives expire. Usually, on the expiry day, traders can either trade their options contracts or let the options expire worthless without trying to sell/buy them.

Expiry day trading is a high-risk, high-reward trade as the market becomes highly volatile and unpredictable when the closing nears. Thus, traders must develop an in-depth understanding of the market, risk management methods, and option pricing before they trade.

Expiry day-specific strategy is a type of strategy that is performed on the day when the options derivatives expire. Usually, on the expiry day, traders can either trade their options contracts or let the options expire worthless without trying to sell/buy them.

Expiry day trading is a high-risk, high-reward trade as the market becomes highly volatile and unpredictable when the closing nears. Thus, traders must develop an in-depth understanding of the market, risk management methods, and option pricing before they trade.

Popular Strategies for Trading Nifty and FinNifty at the Expiry Date

Many pro options traders choose to trade on expiry day. On the expiry day, the Theta decay faster than usual. And all the OTM or out-of-the-money options expire worthless on the expiry day. It gives options sellers a massive winning probability of up to 60% - 70%.

And most of them use some specific options trading strategy to obtain higher profits without significant loss. And below, we will list some of the popular strategies for Nifty and FinNifty at the expiry date. These strategies are available to your Algo (algorithm) trading or options trading app.

And most of them use some specific options trading strategy to obtain higher profits without significant loss. And below, we will list some of the popular strategies for Nifty and FinNifty at the expiry date. These strategies are available to your Algo (algorithm) trading or options trading app.

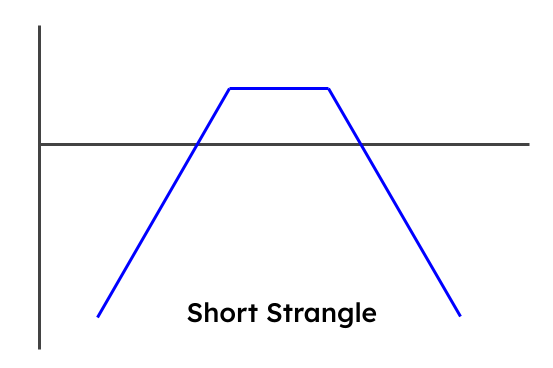

👉 Short Strangle

Short strangle is one of the popular options trading strategies many experienced traders use for expiry-day trade. In a short strangle, the options trader sells all put and call options of different strike prices but all with the same expiration date. The primary reason behind this trading strategy is to profit from the lack of mobility of the underlying asset's price. Using an Algo trading app, you can use this strategy for your Nifty and FinNifty trade on expiry day.

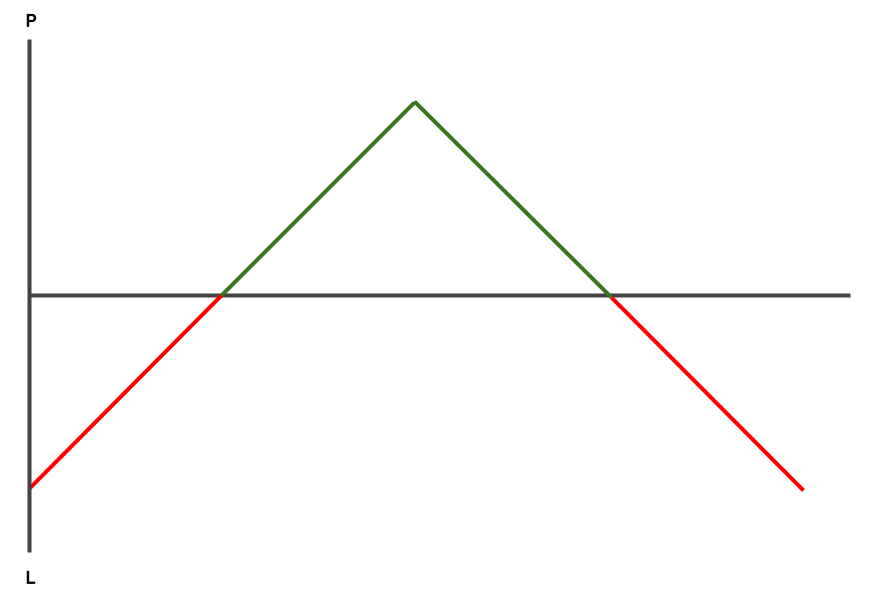

👉 Short Straddle

A short straddle is a popular options trading strategy widely used for expiry day Nifty and FinNifty options trading. In the short straddle strategy, the trader sells all put and call options with the same strike price and expiration date, unlike the short strangle, where the traders sell all put and calls of different strike prices.

However, the primary reason behind this trade is the same as the short strangle (to obtain profit from the lack of underlying asset price movement). This strategy also applies to other essential options trading strategies when you use options trading apps for your Nifty and FinNifty options trading.

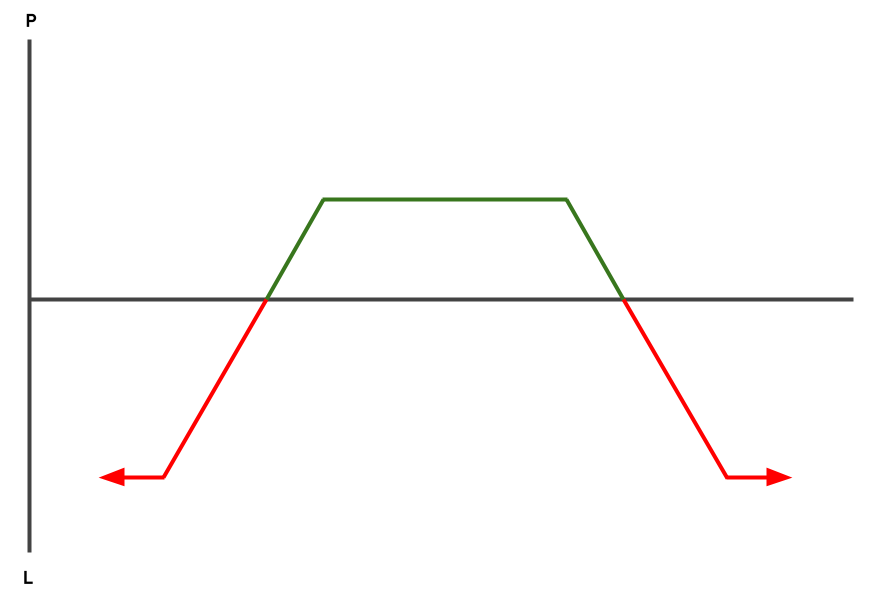

👉 Iron Condor Strategy

Iron condor options-trading strategy is also popularly used to trade Nifty and FinNifty on expiry day. It is also a more profound and complex strategy than the above two and involves selling and buying put and call options to gain profit.

In an iron condor strategy, the trader sells all put and call options of different strike prices but the same expiration date. Then they buy an out-of-the-money call and put options as a hedge. The distance between two strike prices in an iron condor is the potential risk or profit.

The premium earned from selling the options regulates income. And if the underlying asset's price stays within two strike prices at the expiration date, the option will expire worthless; the trader will keep the premium as profit.

But if the underlying asset's price crosses any of the two strike prices, the trader will face a significant loss in the trade. That is why you must take guidance from expert options strategy builders to know the right time and place to apply the iron condor strategy for your Nifty and FinNifty trade at the expiry date.

How can the Short Strangle be used to Trade Nifty & FinNifty Options with OI or Open Interest at Expiry?

Open interest or OI can be helpful to execute a short strangle strategy for Nifty and FinNifty options trading at expiry. And here are the ways you can utilize OI to perform short strangle for the expiry day Nifty and FinNifty options trading.

- Figuring Out Strike Price

Most traders are interested in the index range with the highest OI for both put and call options. It indicates the strike price of Nifty or FinNifty will remain in this range at the expiry. And using the options algo app can help make your expiry day Nifty and FinNifty trade effective.

- Checking Volatility Levels

OI is also helpful in checking Nifty and FinNifty options trading at expiry. Because the high volatility can result in massive price movement, the strike price may swing outside the range, making short strangle unprofitable for trade.

- Evaluating Potential Profit

OI or open interest can also help to evaluate the potential profit essential for expiry day Nifty and FinNifty trade. Measure the potential risk by selling both put and call options at the strike price and check if the combined premium worth your trade risk.

- Implement Stop-Loss Orders

Open interest also helps in implementing stop-loss orders. The stop-loss order is essential to minimize the potential loss if the underlying asset's price moves outside the range.

Other Strategies for Trading Nifty and Finnifty Options at Expiry

Besides the abovementioned strategies, you can follow other essential strategies for trading Nifty and FinNifty options at expiry to make your trade profitable and avoid catastrophic loss. Below we will discuss some other valuable strategies or moves for trading Nifty and FinNifty on expiry day.

- Observe The Market Condition

Observing or monitoring the market condition is crucial for any trading, and there is no exception for trading Nifty and FinNifty options at expiry. You must observe the market closely as it nears expiration to understand its condition. Also, stay updated with the event and news that have the potential to impact the underlying asset's price movement. An options trading app can help you monitor the market and get meaningful insights.

- Learn About the Expiry Date

Learning about the expiration date before you trade your Nifty and FinNifty options is crucial. You must know the Nifty and FinNifty option contract's expiration date to trade at expiry. It will help you eliminate unexpected surprises and make a knowledgeable decision. You can even get help from an options strategy builder for your trade. - Make Use of Technical Analysis

There is no wonder that close observation and understanding of the market and sentiments that affect the underlying asset's price movement are essential to making a wise decision. But the value of technical analysis to make accurate trade is undeniable.

So, to trade your Nifty or FinNifty options at expiry, you must use technical analysis. It will help you determine support and resistance and market trends that can affect the underlying asset's price movement. Also, using the Algo trading app, you can quickly get the technical analysis and suggested moves suitable for the current market trend.

- Develop a Trading Plan

Developing a solid trading plan is essential to trade, and it becomes more crucial when you want to trade on the expiry day. For example, suppose you want to trade your Nifty or FinNifty options at expiry.

In that case, you must develop a proper trading strategy that compiles all vital aspects like stop-loss orders, entry and exit points, and profit goals. You can also get expert opinions-strategy builder assistance to develop a profitable trading plan.

- Risk Mitigation

Risk mitigation or management is also essential to make your trading successful and eliminate significant losses. So, to make your expiry day Nifty and FinNifty trade profitable, you must concentrate on managing potential risks that can lead to a significant loss. Remember that expiry day trade is high-risk, high-reward trade, and you must use stop-loss orders and position sizing techniques to minimize risks.

Conclusion

Many traders participate in expiry-day Nifty and FinNifty options trading for high profits. However, you must note that expiry day Nifty and FinNifty options trading is a highly risky trade with the possibility of enormous gains.

However, as a trader, if you stay patient and disciplined and develop your trading strategy with keen observation and understanding of the expiry day market and underlying asset's price movement, you can obtain significant profit from the trade. Also, professional guidance from an options strategy builder can help you make an expiry day Nifty or FinNifty options trading success.

However, as a trader, if you stay patient and disciplined and develop your trading strategy with keen observation and understanding of the expiry day market and underlying asset's price movement, you can obtain significant profit from the trade. Also, professional guidance from an options strategy builder can help you make an expiry day Nifty or FinNifty options trading success.