Derivative instruments like Options are complex in nature, and the strategies built around them are even more complex. Options strategies can be created with single-leg, multi-leg contracts. These contracts allow you to trade in all market conditions. So maintain your focus on building your option strategies.

Try Option trading strategy builder by

Now let's have a look at top option trading strategies one use to gain maximum benefits.

14 Option Trading Strategies :

1) Orientation

In fact, study a few strategies and apply your trading brain over it to see what works for you best. So below we have discussed generic options trading strategies for different market conditions. They are based on Bullish, bearish & sideways/range bound markets. Let’s get going :

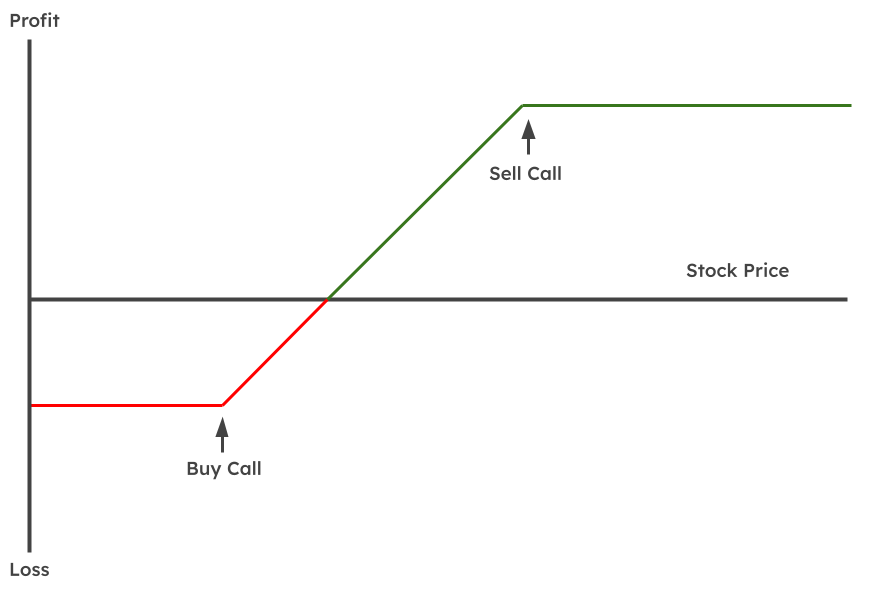

2) Bull Call Spread

This is a 2-Leg strategy & trading is done with 2 or more options. You buy ATM Call options in 1st Leg and Sell OTM Call options in 2nd Leg. But, always make sure all the options in both legs are from a series of the same expiry.

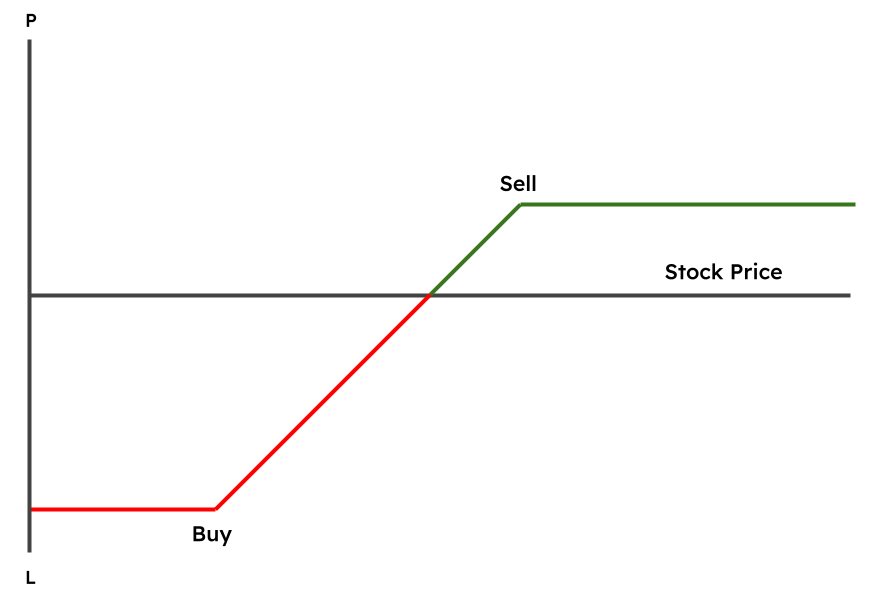

3) Bull Put Spread

Also, wider the spread, higher is the amount of risk associated with it. Consider using this when the market has some good amount of volatility.

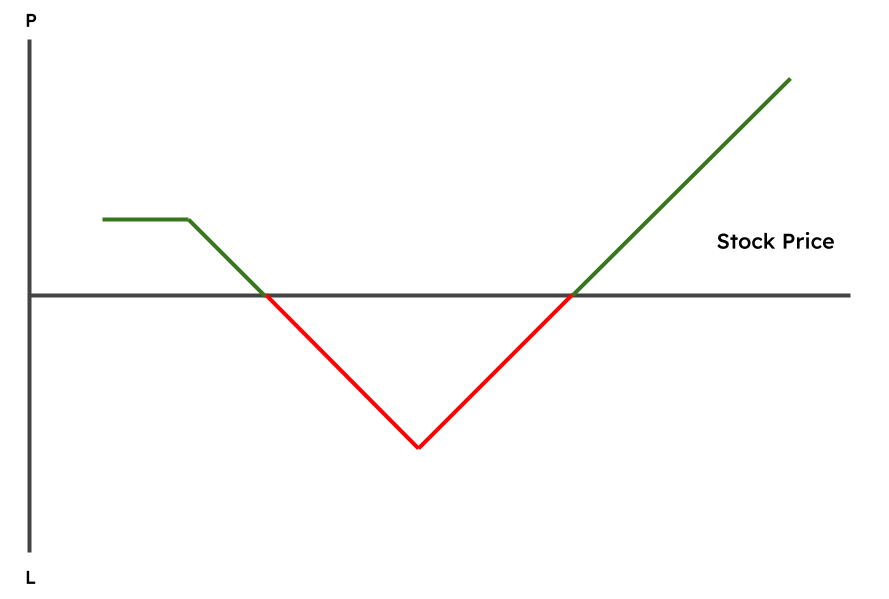

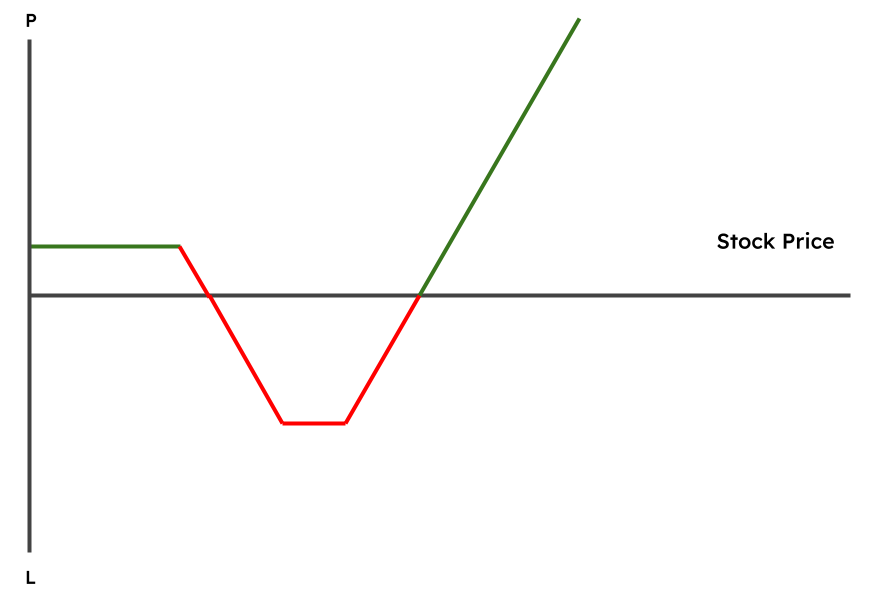

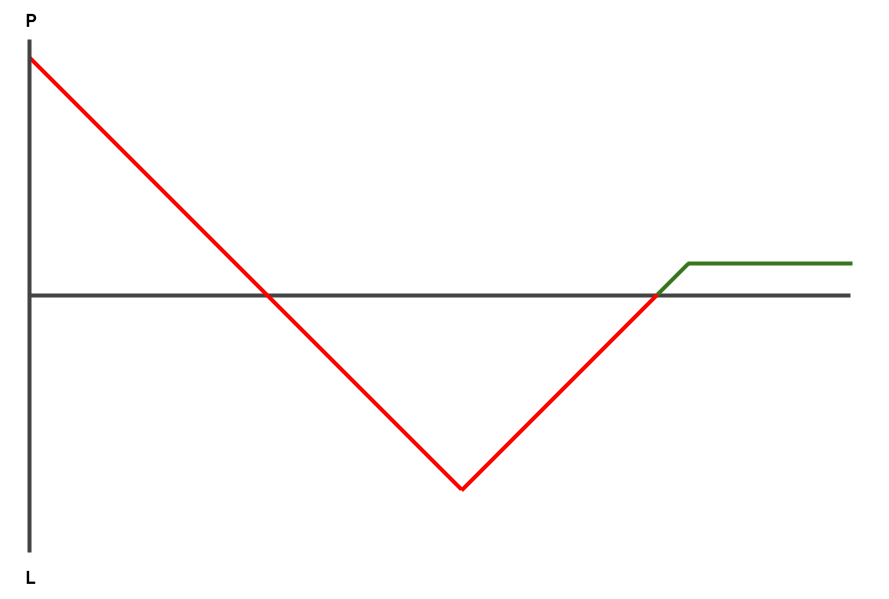

4) Call Ratio Back Spread

That’s why big movements are important for this strategy. Unlike previous 2 strategies, this strategy has a 3-Legged approach. First 2 Legs involves buying OTM call options and 3rd leg involves selling ITM call options. This 2:1 ratio must be maintained.

5) Bear Call Ladder

This options trading strategy has a 3-Legged approach. It is operated in a 1:1:1 ratio. Here you buy 1 ATM call & 1 OTM call and Sell 1 ITM call option. This pattern has to be followed to operate in this strategy. This can be multiplied however. You can operate in 3:3:3 ratio, 5:5:5 ratio and so on.

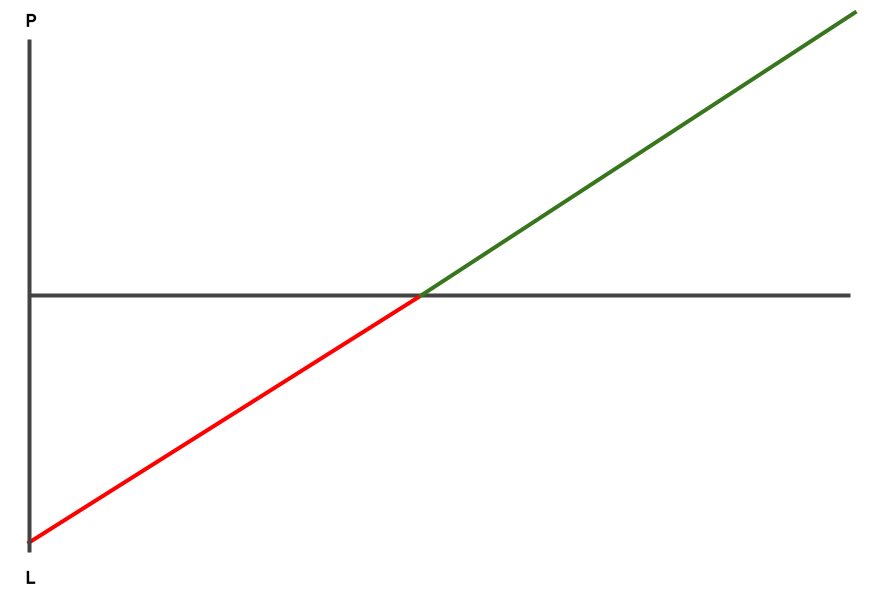

6) Synthetic Long

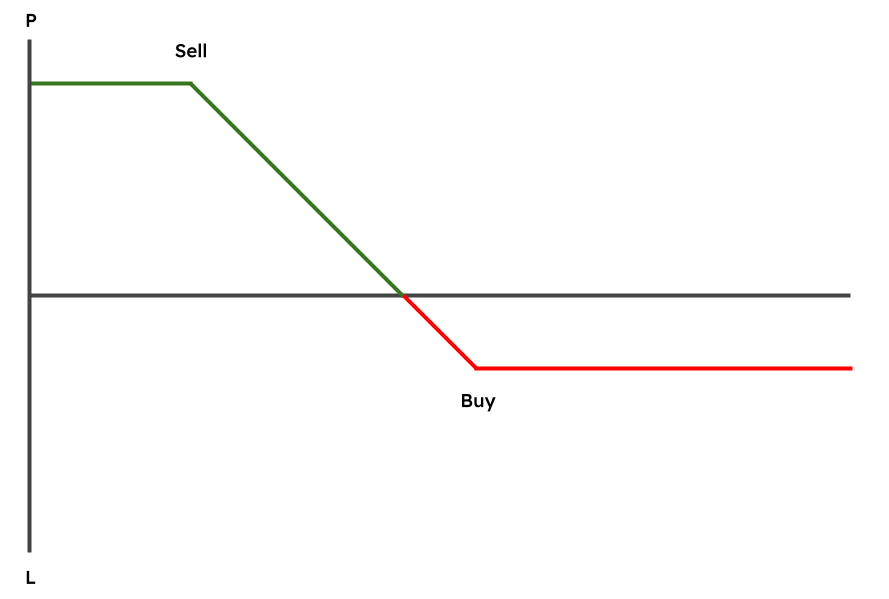

7) Bear Put Spread

Biggest benefit of Bear put spread strategy is that it is Low risk. Traders with an extra cautious approach use this a lot. It results in Lower profit margins but at the same time is much more secure against making Losses. Always remember to pick all options in the same expiry range & they should belong to the same underlying asset.

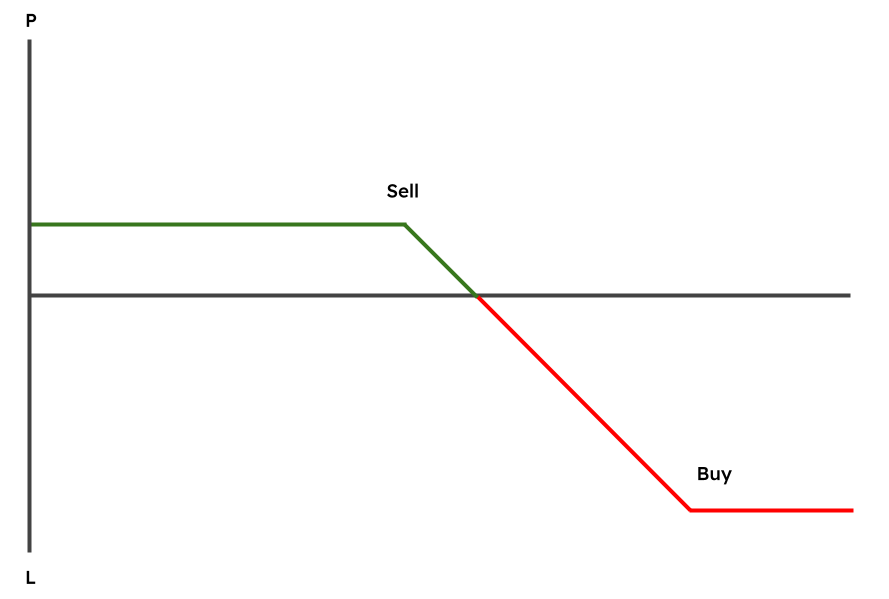

8) Bear Call Spread

This is very similar to our previous strategy. Only difference is you bought Put options previously, here you will buy Call options to create a spread. You should definitely go with this strategy if you are predicting the volatility in the market to Increase. That will increase your profit chances for good.

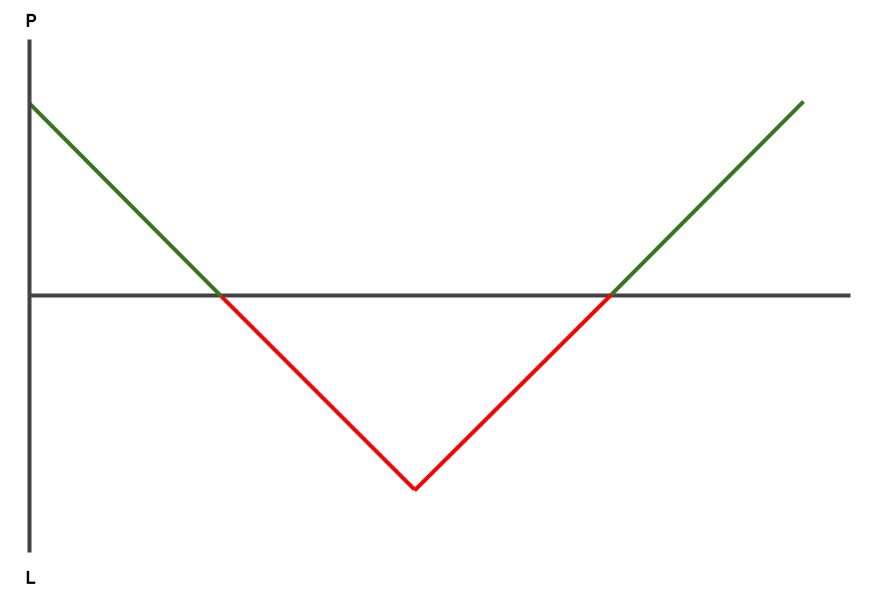

9) Put Ratio Back Spread

The biggest thing to note here is that this Strategy must be deployed when you are expecting Bigger market movements - downside or upside. Not suitable for small market movements. You make money in both cases of the market going down and going up, but it’s important that the market moves Big amount.

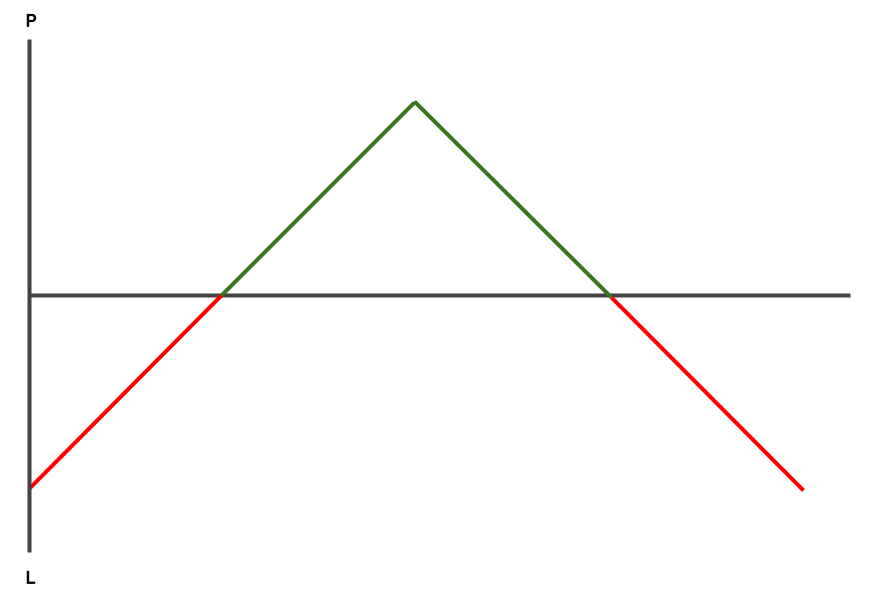

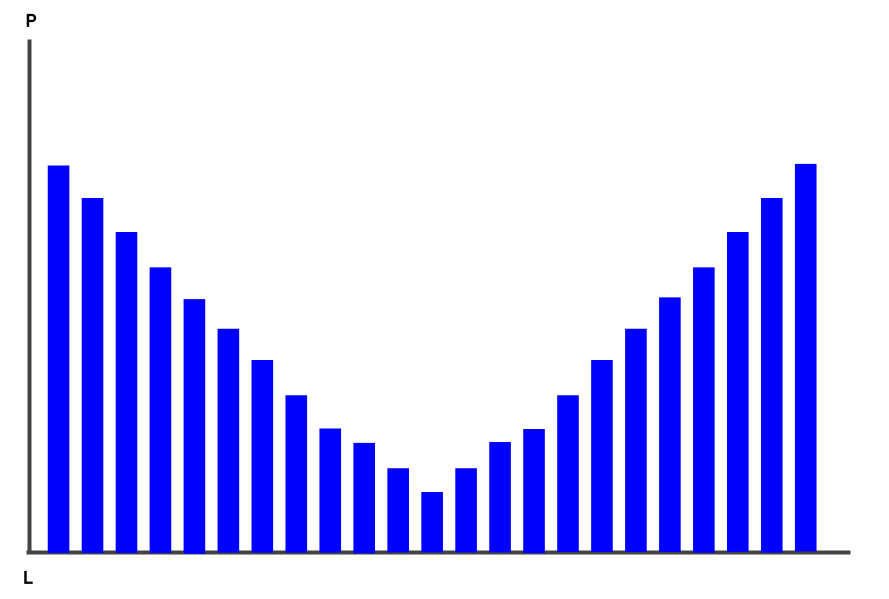

10) The Long Straddle

It’s market volatility. Here you concurrently Buy an ATM call option and Buy an ATM put option. Preferably buy when market volatility is Lower. Then if the market moves a big amount before the option expiry period, you make profits. The volatility must increase after you set-up your Straddle.

11) The Short Straddle

So, a really preferable approach when you predict the market to NOT make big movements. Here you sell the ATM call option & ATM put option. As you are selling options here, you will get Cash flowing into your account. A net credit strategy at the end.

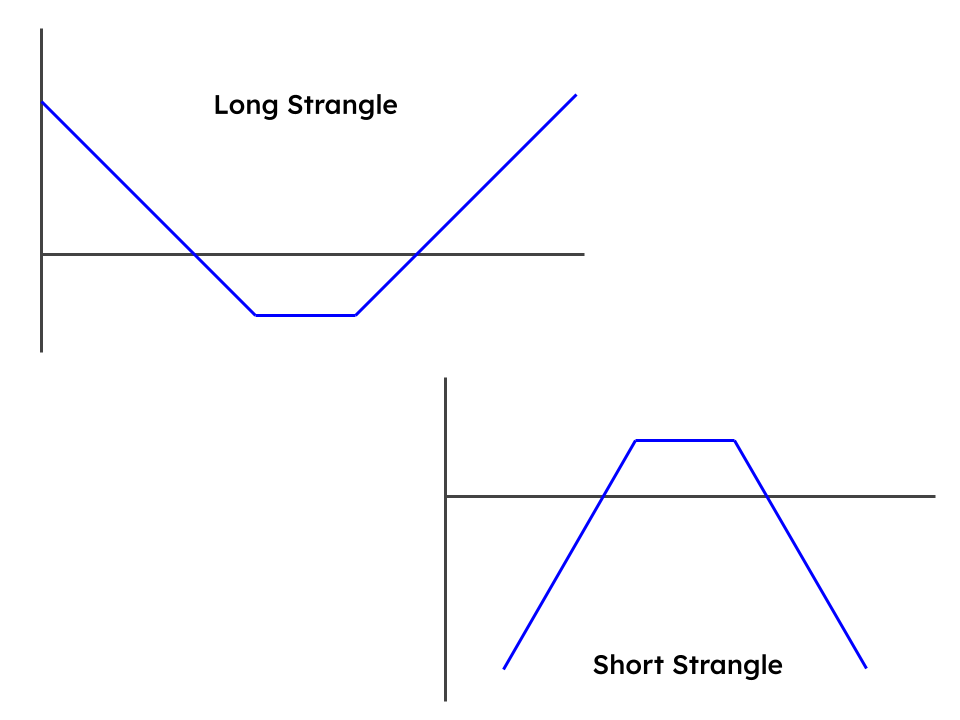

12) The Long & Short Strangle

Long Strangle: Trader buys 1 OTM Call option and 1 OTM put option concurrently. You have to maintain a 1:1 ratio. Multiplication is fine i.e. 2:2, 5:5. But the 1:1 balance must be maintained.

Short Strangle: This is the exact opposite of a long strangle. Here you would be selling OTM call & OTM put options. For obvious reasons, since this is a ‘short’ strangle. To make money with Strangles, the market volatility must increase while you are in the trade & Before the option expires.

13) Max Pain & PCR Ratio

PCR Ratio :

PCR ratio is

‘

Total option interest rate of puts

’

divided by

‘

total open interest rate of calls

’

. Now this ratio helps traders decide the Bear/Bull behavior of the market. If the ratio suggests Bull, then the market is expected to show ‘Bearish’ behavior, and vice versa.

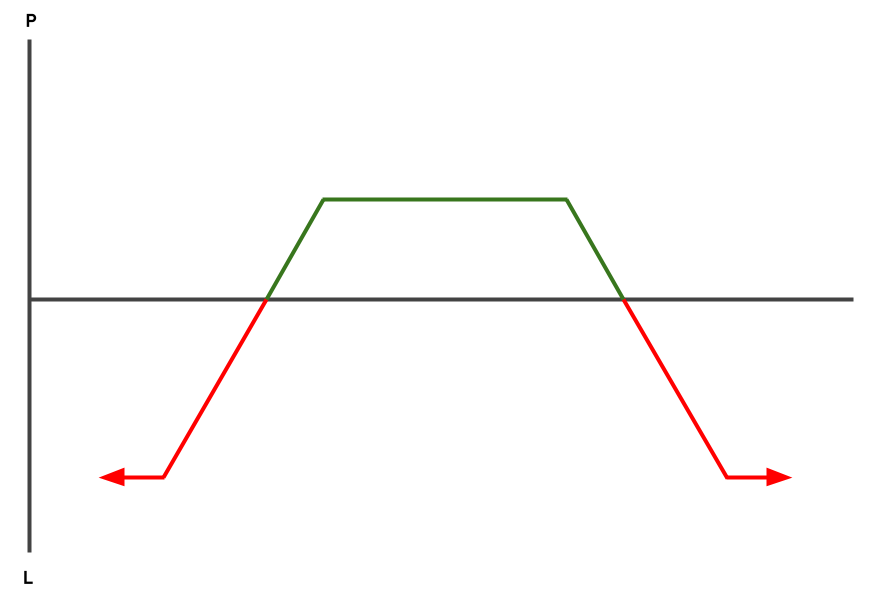

14) Iron Condor

Iron condor is a protective mechanism version of Short strangle. Here you deal with Long OTM calls and Long OTM puts. These OTM calls will cover the both side ends of your short strangle. Hence reducing your loss potentials significantly. Some reduction in profit is possible, but the protection you get is supremely beneficial.

Automate Your Trading Strategy

Download now

Benefits of using SpeedBot for Options Trading Strategy Builder

Last but not least: SpeedBot is brilliantly tech-powered on the back-end with artificial intelligence and machine learning technologies. So it will guide you with strategy building based on not just historical data, but with past market movements, behavioral patterns formed before and so many other things. Enabling you to come out with Rock solid option trading strategies.