With the introduction of digital computing and the fast growth of electronic systems for carrying-off trading operations, the basic realm of trade has recently experienced a sea shift. Trading alternatives, as well as trading methods, are many in today's world. Profitable algorithmic trading, or algo investing, is one of the key sectors that has developed as a good and developing buying and selling style.

Throughout the trading community, algo trading would also be known as black-box trading since algorithmic trading systems distinguish it. Trading is conducted digitally at a particular intensity of placement and implementation in this sort of transaction. This indicates that investment choices are made using algorithms and pre-programmed programs because there is no human participation in the natural modality of investing.

Trading Algorithms

Algo dealing, as previously said, requires very little human work and is instead carried out by robots. This allows for the execution of some projects that would not have been doable with simple human labor. The basic investing model is constructed, and deals are carried out using software programs and methodical algo trading app programs. Planning, pricing, quantity, or any computational formalism are all factors that influence these commands or described groupings of instructions. Apart from allowing the dealer to benefit, algo-trading makes markets greater fluid, making trading increasingly organized by removing the impact of human emotions on trading.

Pure Data

Stock traders, trade execution, cash flow management, and regulatory compliance are all basic components of a customized algorithm trading system. An automated forex trading system's operating techniques are at its heart. Complex algorithms can evaluate data (price including news feeds) to uncover observed phenomena, discover lucrative trends, or locate competing methods and exploit the knowledge. Trading systems employ various methods involving norms, fuzzy rules, quantitative tools, principal component analysis, advanced analytics, and information retrieval to result in sectioning information from pure data.Real-Time Analysis

A machine can conduct financial deals at velocities and repetitions that a human broker cannot. Market participants and analysts on platforms must reveal trade information to the general public within 90 seconds of implementation under real-time analysis. Near-real-time trading data promotes transparency and predictability, traceability, and productivity for trading platforms.

Precise Orders

The rapid advancement of special orders in Algo-trading is evidence of its effectiveness. There are several advantages to this as well, including:

As a result, the odds of accomplishment are increased by placing orders quickly and accurately. Traders can prevent large price swings by timing their trades precisely and instantly.

Concurrent inspections for an insurance company in exchange can be made on various templates and strategies, lowering transaction fees dramatically.

There will be a significant reduction in the number of mistakes while placing mechanical transactions.

A backtesting function allows traders to assess the feasibility of a technique by testing its conclusion using real-time and previous data before implementing it.

Mental and behavioral factors, as well as the errors that emerge from them, are fully eradicated.

As a result, higher transaction attempts to secure profitability by employing pre-programmed commands to place a customer's order quickly across different strategy templates using various decision factors.

Summarised Reporting

Algorithmic trading sometimes referred to as algo-trading, black-box buying, and selling, or computerized investing is a way of completing trade orders using pre-programmed automatic trading procedures. The computers transmit tiny slices of the transaction to the market and ultimately consider numerous variables, including time, pricing, and quantity.

The study divides the advanced trading sector into four categories: asset managers, small investors, long-term businessmen, and short-term traders, constituent products and solutions, cloud versus on-premise implementation, and organizational characteristics (medium and small businesses vs large businesses), and geographic region.

Algorithmic trading is a fascinating topic. The more one learns about it; the better one recognizes its advantages. Buying and selling are significantly more realistic when employing a systematic technique than emotional or instinctual forecasts. After properly recognizing a potential opportunity, the algorithmic trading program performs the same as the operator. Nevertheless, an algorithmic trading system is required to follow the specified orders.

Conclusion

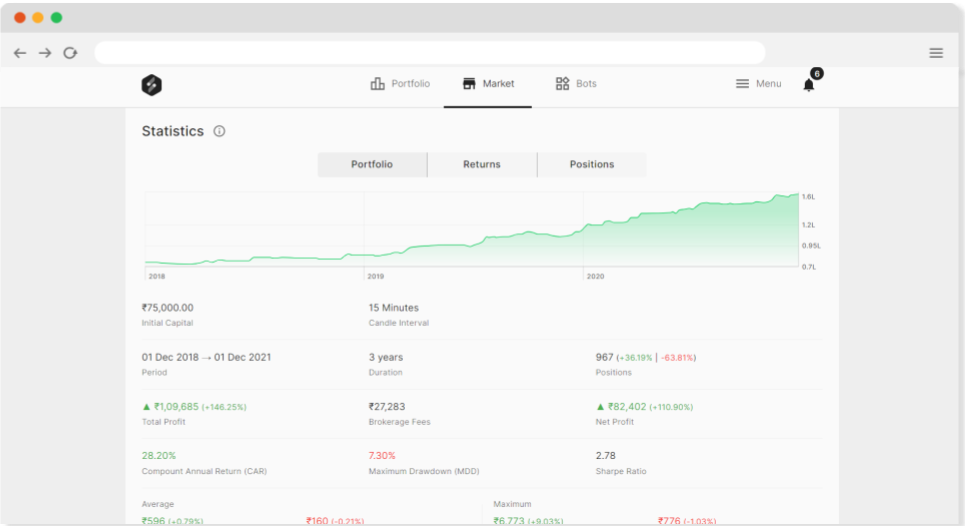

Although algo dealing is the new-age dealing that is anticipated to become the dominating type of dealing in the near term, institutional investing seems to be something that requires solid advice. In comparison to human dealers, this type of trading tries to take advantage of computers' velocity and processing capabilities. Algorithmic trading has gained popularity among retail and commercial investors in the 21st century. SpeedBot is one such Algo-Trading Platform filled with Rich Features like NoCode Bot Builder, BackTesting Engine, Paper trading Mode, Trading Engine, Broker Integration, etc

It's often used by hedge funds, pension financing, collective investment schemes, and other multidimensional investments that require stretching out the processing of a larger request or executing transactions too quickly for human dealers to reply to. High-frequency dealing (HFT), for example, is a sort of algorithmic trading characterized by high turnover and increased request-to-trade ratios.

Planning to deploy a TradeBot for you?

Join us and make your profits.