Get SpeedBot App and Try Options Strategy Bot Templates

Options Algo Trading Simplified with Strategy Bot Templates

Adapt the Options Strategy Templates

Explore the proven Options strategy templates library. Learn about the Options trading strategy rules for market outlook, risk tolerance, and the desired results.

Build Your Strategy on Top of Templates

Create your Options Algo Trading strategy within a few clicks. You do not need to Code this Options trading Automation. It just needs your configuration with a few clicks with Bot Builder.

Design Your Own Trading Recipe for Options Trading

Easily Deploy Strategy With SpeedBot Templates

Clone the Template

Modify & Backtest

Set it Live

Not getting what you want? Connect for custom strategy development

Options Bot Templates

Bot Templates are pre-created strategies based on the various strategic approach of Options trading derived out of the Technical Analysis. Each such template is re-built and ready to use. You can see all the templates in details, describing which Trading Symbol is traded, Entry and exit criteria, and the description notes explaining the logic behind these strategies.

Upon cloning these Template Bots - they are editable with all the Trading Rules visible in the Options strategy builder.

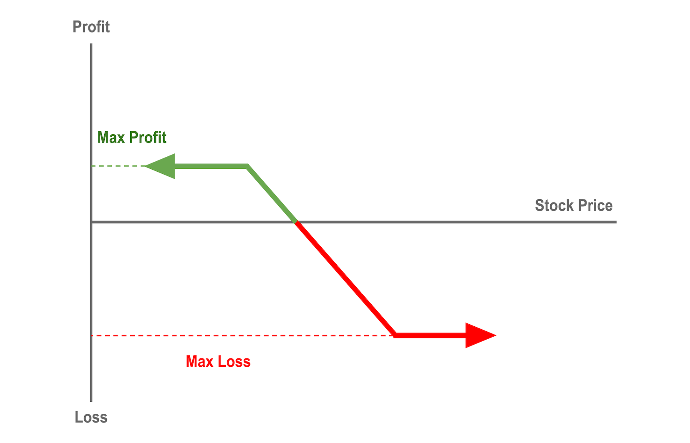

Bearish Call Spread

NIFTY 50 | ( 937 Clones )

Market Outlook: Expecting a Bearish Market Movement

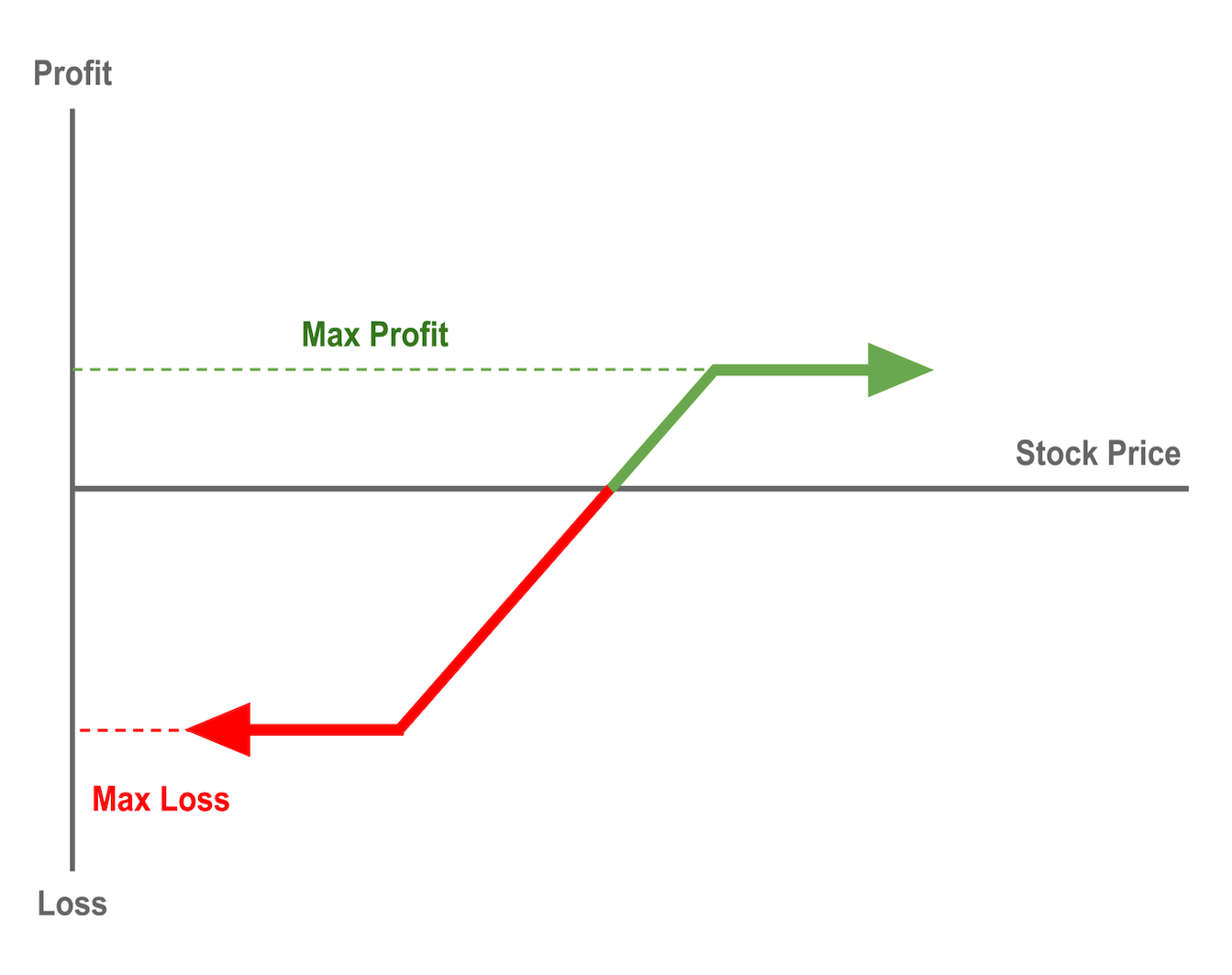

Bullish Put Spread

NIFTY 50 | ( 1194 Clones )

Market Outlook: Expecting a Bullish Market Movement

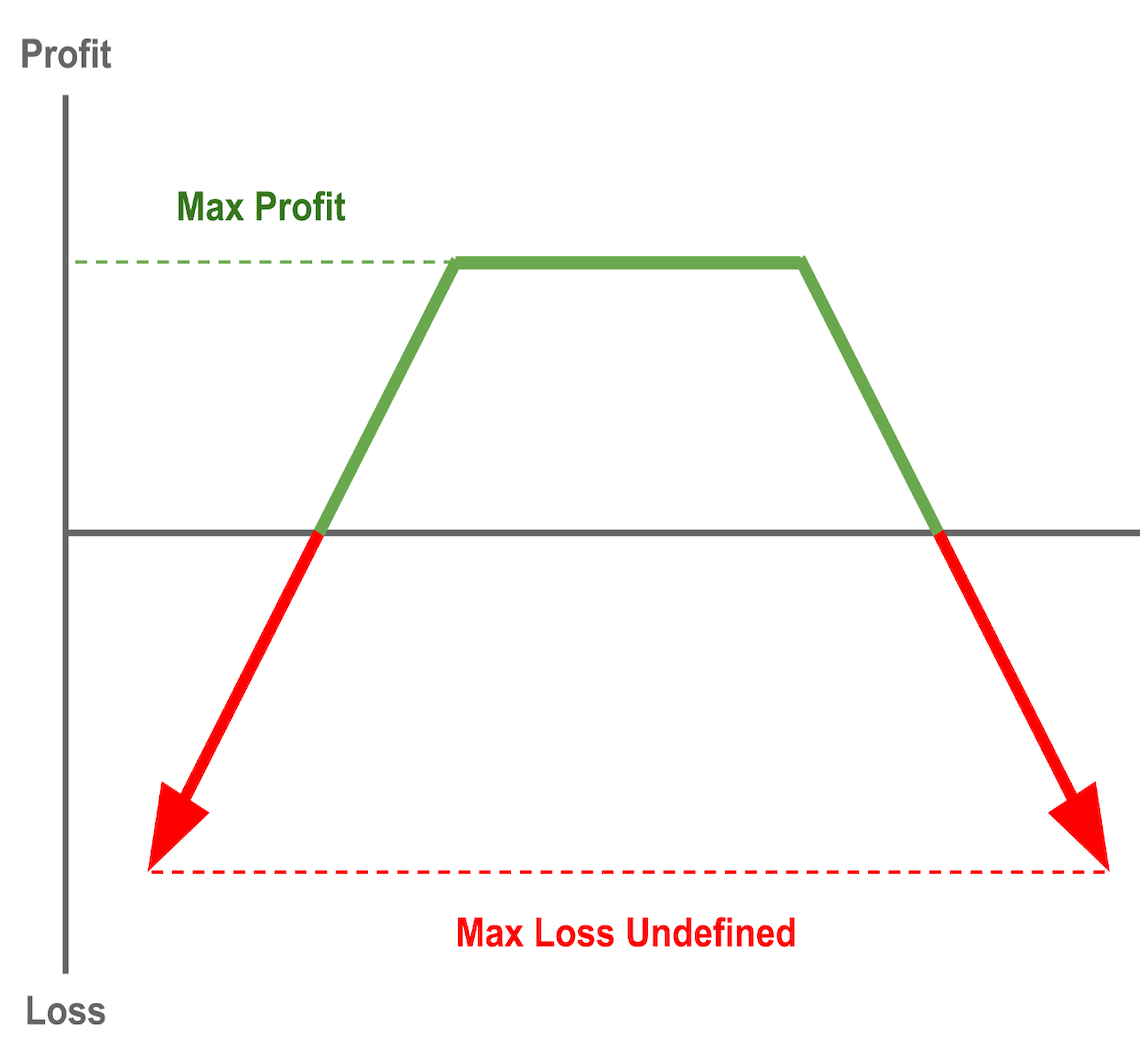

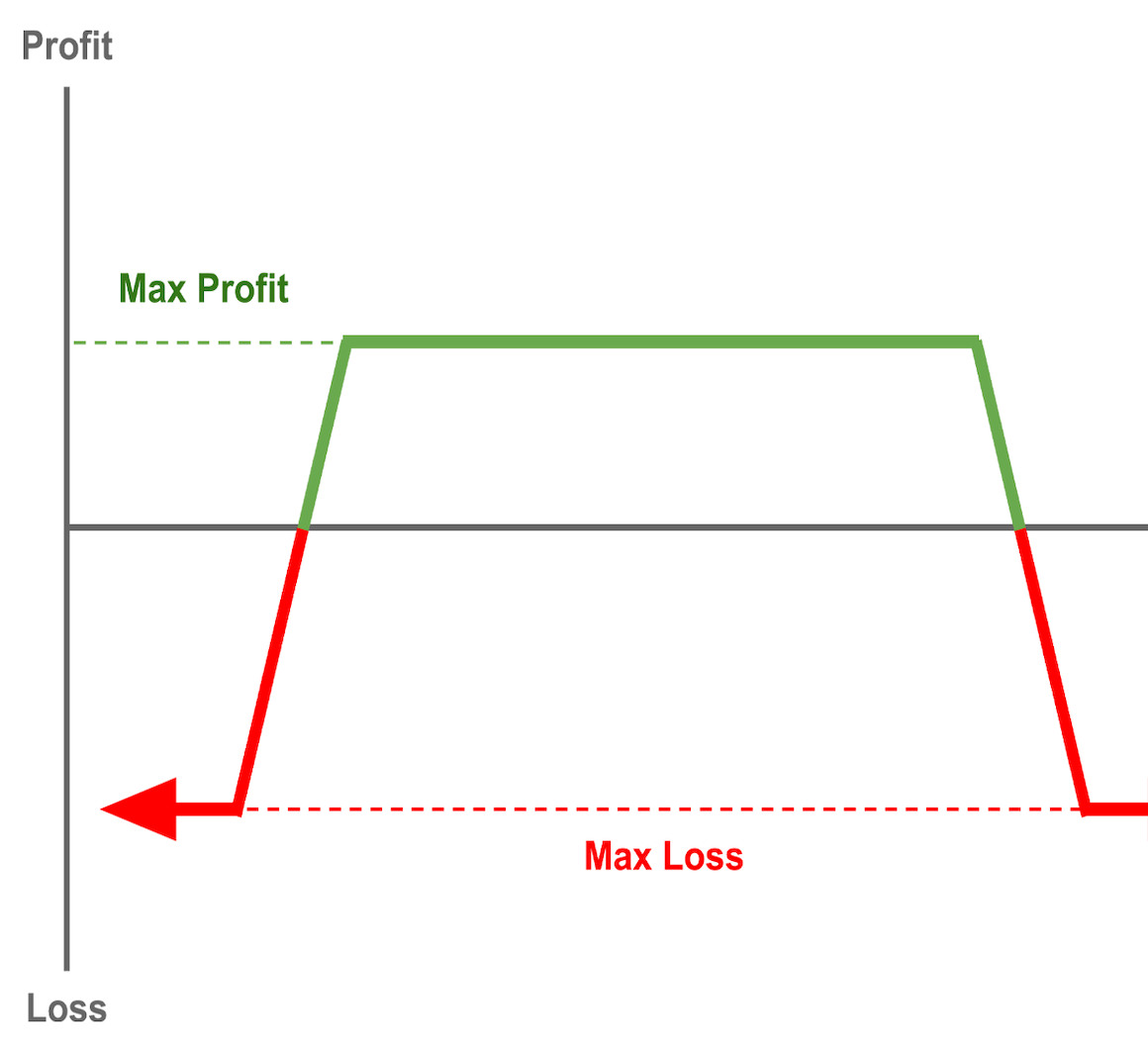

Short Iron Condor [ 4 Legged Strategy ]

NIFTY 50 | ( 1457 Clones )

Market Outlook: Anticipating Low to Moderate Volatility

Strategy: Combining Short Call and Put Spreads

Risk: Limited to the Width of the Spread Minus Net Premium Received

Reward: Limited, but Potential Profit from Range-Bound Market

Breakeven Points: Vary Depending on the Strike Prices of the Short Call and Put Spreads

Loss: If the Underlying Asset Moves Significantly Beyond the Range of Strike Prices

Considerations: Used in Low to Moderate Volatility, Profit from Range-Bound Markets, and Requires Monitoring for Risk Management

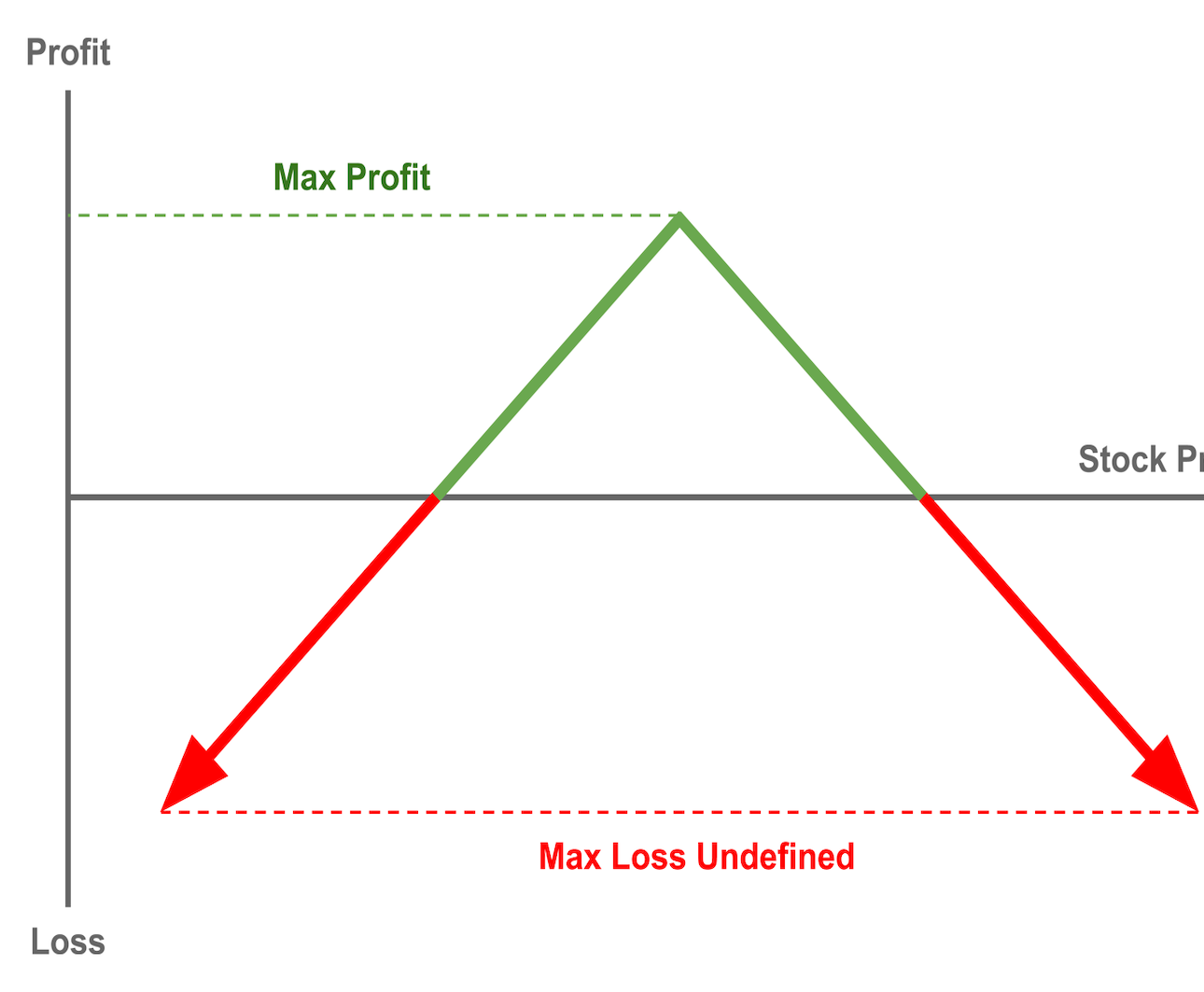

Momentum Strategy Template

Momentum Master employs hedged strangles, offering an innovative approach to options trading.

Momentum Centric Approach

This Strategy approach to capitalize on market momentum, Momentum Master can benefit from price swings in either direction.

Risk Management

In this Option Strategy template, strategic hedging reduces potential losses and enhances the overall risk-adjusted returns.

Explore Advanced Strategy Templates with SpeedBot

Advanced options strategies provide experienced traders with a wide range of tools to address specific market conditions.

Want To Learn About What Options Strategy Builder Is & How It Works?

Disclaimer: The published Algo Trading Templates provided on this website serve as examples and references to facilitate learning about SpeedBot Automation Tools. It is important to note that these templates do not constitute any form of advisory from the SpeedBot Team or its employees. These templates are intended for use in the development of trading bots on the SpeedBot platform, offering a quick and reusable structure for trading users interested in creating their own Auto Trading Bots on the SpeedBot platform.

Furthermore, any Trading Automation Bot that users create or clone, and subsequently run as automation on the cloud-based platform, functions as a computing and API-integrated piece of software. These Automation software, referred to as "Bots" herein, are subject to technological issues related to integrations with the broker's platform. It's essential to understand that such integration-related issues are not the liability of the SpeedBot platform. Users should exercise due diligence and use these templates and Automation Bots at their discretion.