If you're interested in trading options, it is essential to have a plan of action. It takes more work to figure out which strategy to implement. Creating a unique strategy is even more complex when the situation calls for it. Beginners and experienced traders may need help keeping track of the best strategies. Here options strategy builder can result in great help.

If you're searching for a tool that can help you design strategies quickly and easily, there are multiple options trading apps. It can create the strategy according to the choice and preferences. The online builder is user-friendly and allows you to create customized strategies with ease. All you need is a device - laptop, mobile phone, or desktop - and you're ready to go. Let us explore more about it:

Overview of Options Trading and Trading Values

Trading strategies involve using various technical indicators to construct methods for trading options. These indicators customize to fit a particular trader's style and the type of asset being traded. By taking advantage of these indicators and options auto adjustment strategy, traders can develop effective techniques for trading options.

Traders of futures and options rely heavily on technical indicators to decide their trades. It is essential to have a good understanding of futures and options trading, calculations, and terminology.

In addition, the trader must be familiar with technical indicators essential for any successful trader. To make trading more straightforward, the options trading app provides traders with the necessary tools and support.

Strategy Builder: Definition

The Options Strategy Builder is a tool designed to help investors create and optimize their options strategies. It was developed to simplify constructing and executing complex option strategies. With this, investors can more easily make informed decisions.

Using these tools for options trading offers you the benefit of improved price identification and smooth implementation of your strategy. Additionally, the options trading app allows you to set up trading parameters in advance. It eliminates the need for constant market monitoring. As a result, it can help you save the cost of chances that traders may lose.

Creating The Options Trading Strategy With Strategy Builder:

To create the options strategy. Just go to the scrip details page of the symbol you want and work through the following steps:

Stage 1:

To view the summary of a stock strategy or option chain, click on the 'Summary' tab and then on either the 'Build Strategy' button or the 'Option Chain' tab.

Stage 2:

You will be asked to click on the strike price of your choice on the LTP (Last Trade Price) of the chain on our web platform, which will provide you with the option to either buy (B) or sell (S).

Stage 3:

Tapping on the order entry will prompt you to choose or enter the trade's size, amount, and cost. After that, you can press the 'Add to strategy' button to complete the transaction.

Stage 4:

The review tab at the bottom of the page will contain the order.

Stage 5:

Continue building on your strategy by adding additional legs to your position. Keep tapping into the market and adding more orders to maximize your potential profits.

Stage 6:

Once you have finished paraphrasing, tap on the review page to view a summary of your selection. From here, you can then click on the 'Continue' button to move on.

Stage 7:

Clicking on 'Continue' will take you to the following page to confirm the orders.

Stage 8:

Clicking on 'Continue' will bring you to the next stage of finalizing your orders.

Distinct Option Trading Strategy:

Options auto adjustment strategy refers to how traders call and put options. Moreover, it limits their risk and maximizes their profits. It can involve buying and selling both call and put options. In addition, it also includes combining the two depending on the trader's objectives.

These strategies can involve complex calculations to determine the best way to hedge or leverage their investments. In addition, it may involve simultaneous buying and selling options to achieve their desired outcomes.

Call options give the holder the privilege to purchase the fundamental shares. Also, put options allow the owner to sell the underlying stock at an agreed-upon price. This process takes place before the expiration date. Options strategy builder strategies have bullish, bearish, or neutral categories, depending on the investor's market outlook. Let us explore the details:

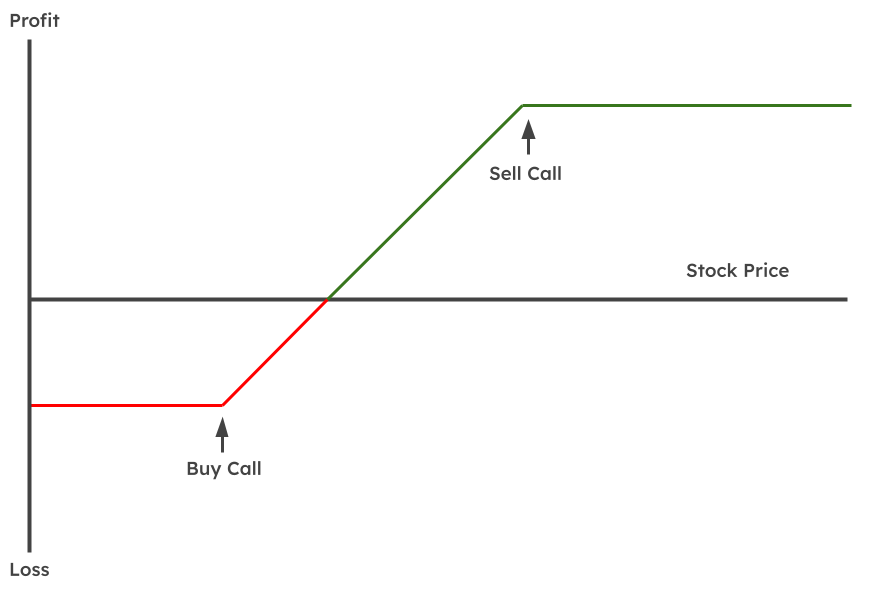

1. Bull Call Spread Strategy

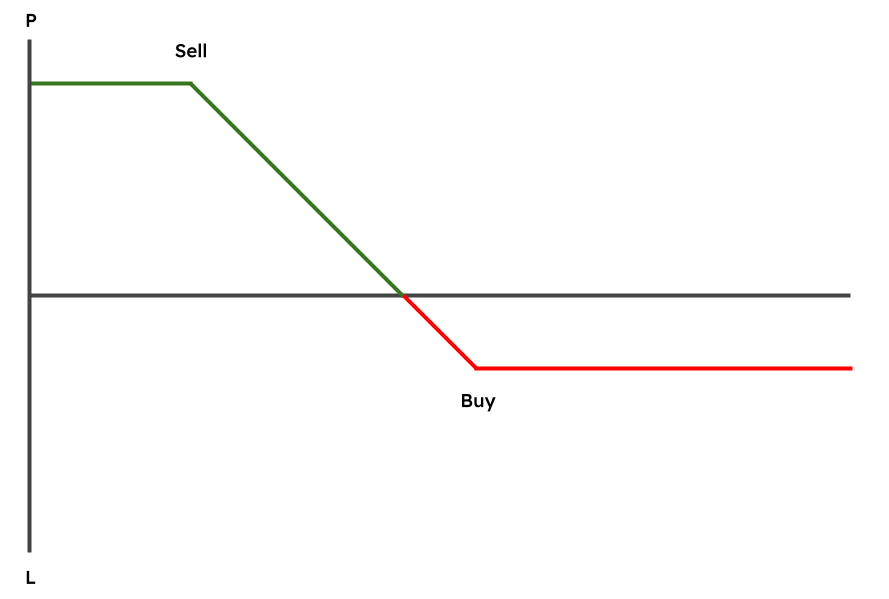

The Bull Call Spread options strategy builder involves buying a lower strike call and selling a higher strike call. Therefore, it works intending to make a profit when the price of the underlying stock rises.

Losses incurred when the stock price falls and are equal to the net debit. It is the premium paid for the lower strike call minus the premium received for the higher strike call. This strategy helps to protect against losses when prices fall, but the profit potential is limited.

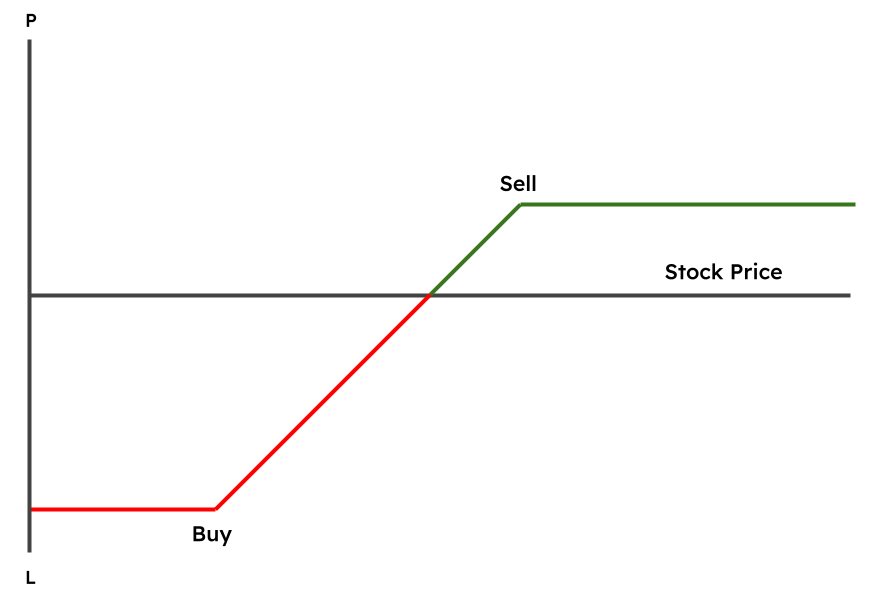

2. Bull Put Spread Strategy

In a Bull Put Spread, it is essential to remember that both puts must have the same underlying stock. In addition, it must have the same expiration date. This spread is for a net credit, meaning the investor will receive money upfront on the options trading app. The maximum profit is limited to the net credit received.

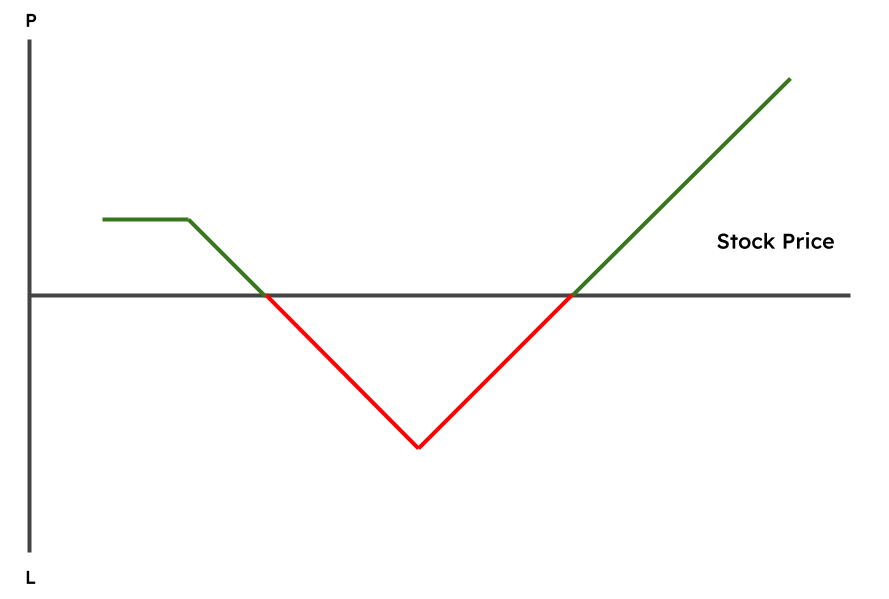

3. Call Ratio Back Spread Strategy

This strategy allows traders to maximize unlimited potential profits when the market increases. In addition, it limits their losses to a predetermined amount if the market goes down. It involves buying two out-of-the-money (OTM) call options and selling one in-the-money (ITM) call option. Thus, if the market stays within a specific range, the trader can profit from the premiums of the options.

4. Synthetic Call Strategy:

This Protective Put options strategy involves buying a put option on a stock that we hold and have a bullish view. It will protect traders from potential losses if the stock price falls. It intimates traders to sell the put option at a higher price than the premium paid for it. At the same time, one can also benefit from any potential rise in the stock price.

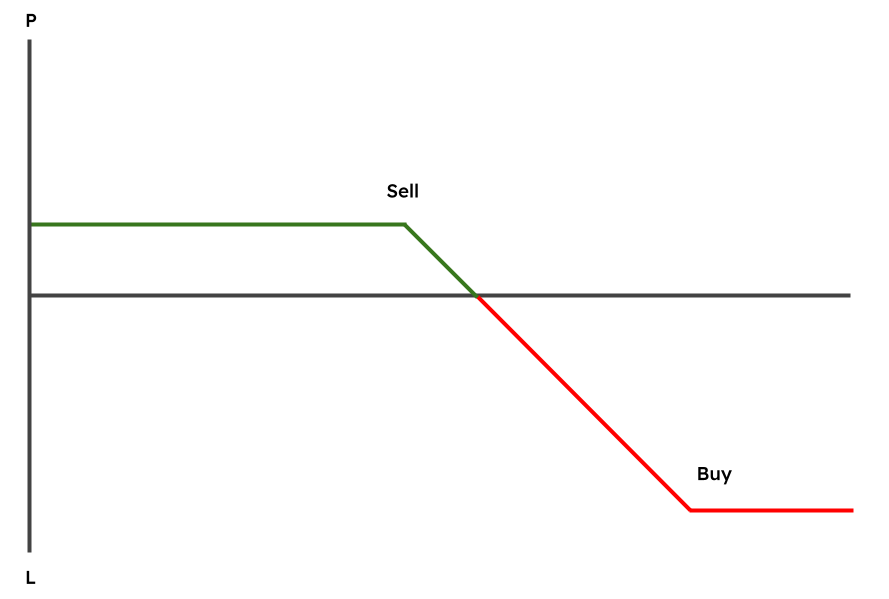

5. Bear Call Spread Strategy:

This options strategy builder entails purchasing a higher strike price Out-of-the-Money Call option and selling an In-the-Money Call option. It functions with a lower strike price, on the same underlying security, and with the same expiration date. Moreover, a bear call spread is for the net credit, and profits are gained if the stock price declines.

6. Bear Put Spread Strategy:

Traders may use the Bear Put Spread strategy when they anticipate that the market will decline but not drastically. This strategy on the options trading app involves purchasing an in-the-money put option and selling an out-of-the-money put option. It is with the same underlying stock and expiration date.

7. Strip Strategy:

A strip is bearish to a neutral options strategy that involves purchasing a single at-the-money call option and two at-the-money put options. It includes the same underlying security with the same strike price and expiry date. This strategy can be profitable when the stock price moves up or down at expiration. Hence, it is typically more profitable if the price moves downward.

Final Word

In conclusion, the option strategy builder is a straightforward and intuitive tool for traders. It takes little time to figure out how to use it. In addition, it analyses the value it provides is well worth the time invested. Therefore, if you're looking for a way to simplify your options trading process, you should try it.