Options are one of the best investment tools that help individuals and companies make their portfolios more profitable. Options trading strategies are often employed to improve risk-reward, in case used well. Here, in this article, we will attempt to explain different long-short strategies for options trading to use in Algo Trading App. Using the same, you can improve your reward compared to the risk.

Long-short strategy: Options to maximize risk-reward

Options, a popular tool for traders, leverage their fast-moving price to make money more quickly than other instruments. While options strategies can be simple or complex, there are different payoffs.

Most options strategies work on two main types of options: the call and the put. The long-short strategy uses long and short asset using a bull or bears spread and vice versa. Here are some ways on

How To Create Options Strategies?

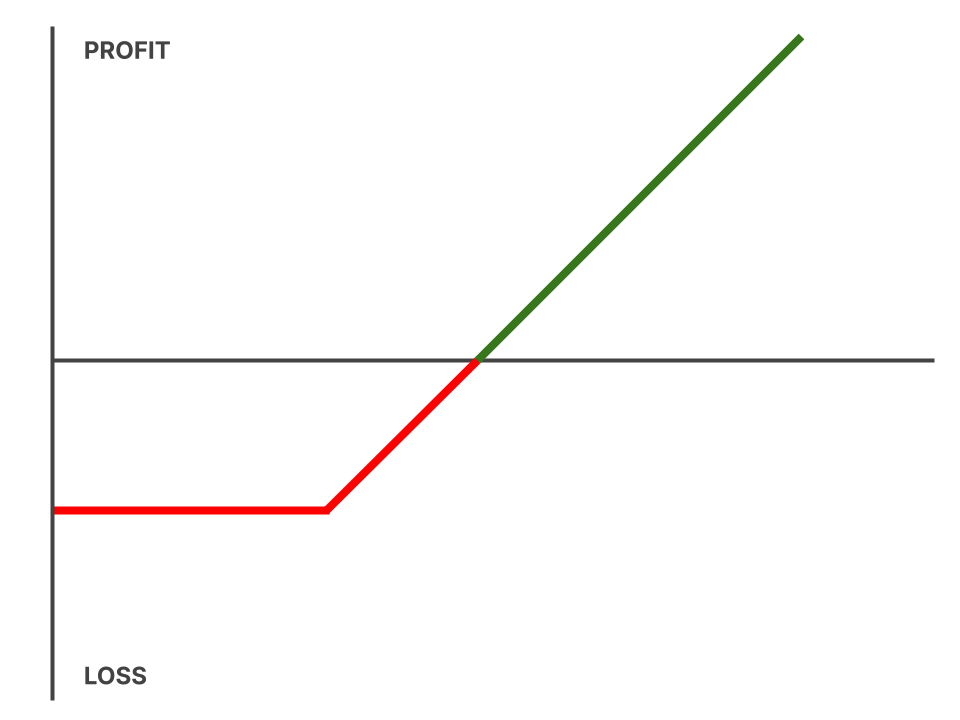

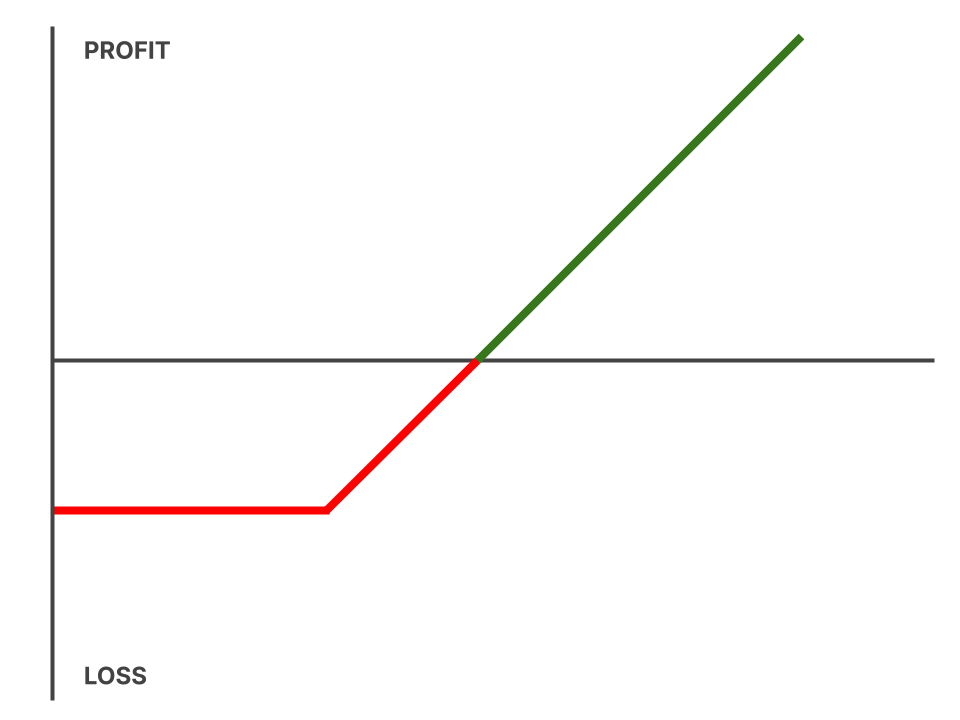

👉 Long Call

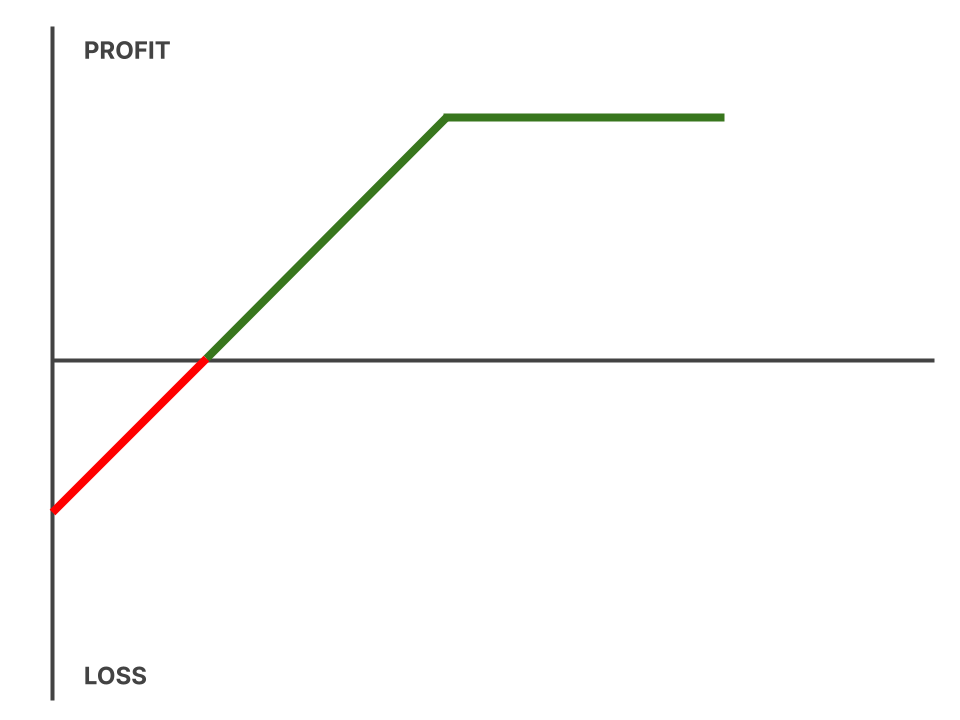

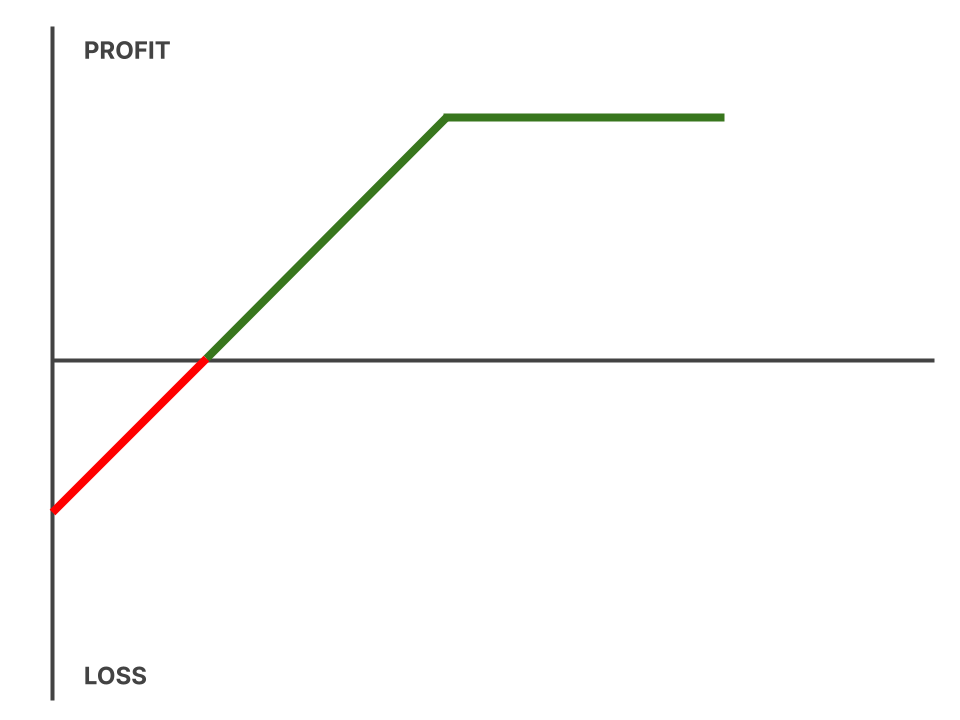

In this type of strategy, the trader needs to buy a call or “go long” a call. The trader hopes that the stock price will become higher than the strike price at the time of expiry. The best part is that the upside on this trade can be a lot. When the investment soars, the traders get to make a lot of money, compared to the initial investment.

As mentioned here, the upside on a long call is limitless. When the stock increases before expiration, the call keeps soaring too. Hence, long calls are considered one of the most powerful investment methods to wager the increased stock price. However, talking about the downside of the long call, there will be a significant loss to the investment. In case the stock lies lower than the strike price, the call will expire without bringing the trader any money and they lose everything.

A long-call strategy can be used when you are confident that the stock is going to become higher than the strike price before the option’s expiration. If the stock does not rise much and becomes only a little higher than the strike price, you can still mint money from this options strategy. However, you might still struggle to get the premium amount. This means that you will suffer a substantial loss.

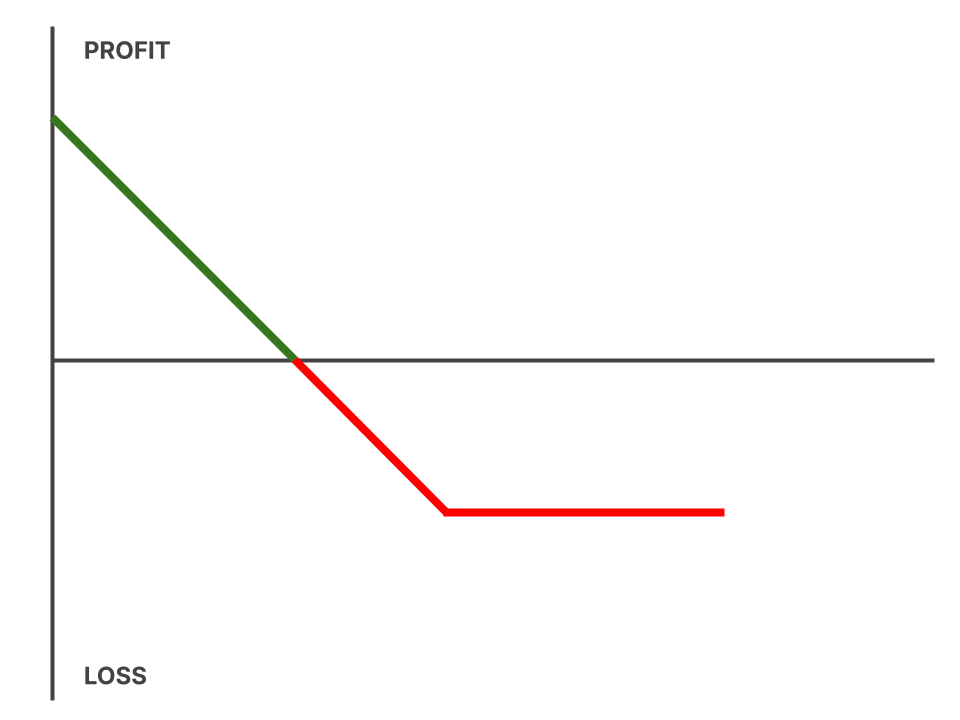

👉 Covered Call

In the covered call Options Trading App, you need to sell the call option or go short. When the trader sells a call, they buy the asset underlying the option. Since the asset may become risky, - the short call turns into a safe trade to reap income.

In this case, the traders always hope that the stock price will become lesser than the strike price at the time of expiry. If the stock becomes higher than the strike price, the owner needs to sell the asset to the call buyer matching the strike price.

One of the things that you need to know about the covered call is that the upside is limited as per the received premium. This works irrespective of where the stock goes and by how much. It is a certain thing that the traders cannot make more money than that.

However, when it comes to the downside, the traders can lose a lot more. so, the profits made through the increase in the stock price are neutralized by the short call. In the case of a downside, the stock investment goes for a complete toss. When the stock becomes zero, it offsets the premium. Hence, the covered call can leave you with major losses in case of stock price falls.

A covered is the best strategy to make money if a trader has the stock and it does not look like increasing significantly. It can change your existing holdings and make them liquid. Mostly, old investors use a covered call strategy who need to generate income and use it for their tax-advantaged accounts. Else, they will have to bear the taxes on the premium as well as capital gains, in case the stock calls.

👉 Long Put

Here, you buy a put or “going long” a put. You hope the stock price remains lesser than the strike price by expiration. The benefit of this style of trading can be a lot in case the stock drops substantially. Just like a long call, its upside is good because the profit remains in the multiples of the option premium. Since the stock does not go negative, it limits the upside, unlike the long call that offers unlimited upside.

Long puts are one of the most popular and simplest ways to wager falling stock. Also, they are much safer than asset shorting. Talking about the downside on a long put, it is also capped. When the stock price is higher than the strike price at expiration, the put becomes zero and you suffer a total loss on your investment.

A long put is the best strategy if you think that there will be a falling in the stock. If the stock falls marginally below the strike price, you get money but not the complete premium.

Long puts are one of the most popular and simplest ways to wager falling stock. Also, they are much safer than asset shorting. Talking about the downside on a long put, it is also capped. When the stock price is higher than the strike price at expiration, the put becomes zero and you suffer a total loss on your investment.

A long put is the best strategy if you think that there will be a falling in the stock. If the stock falls marginally below the strike price, you get money but not the complete premium.

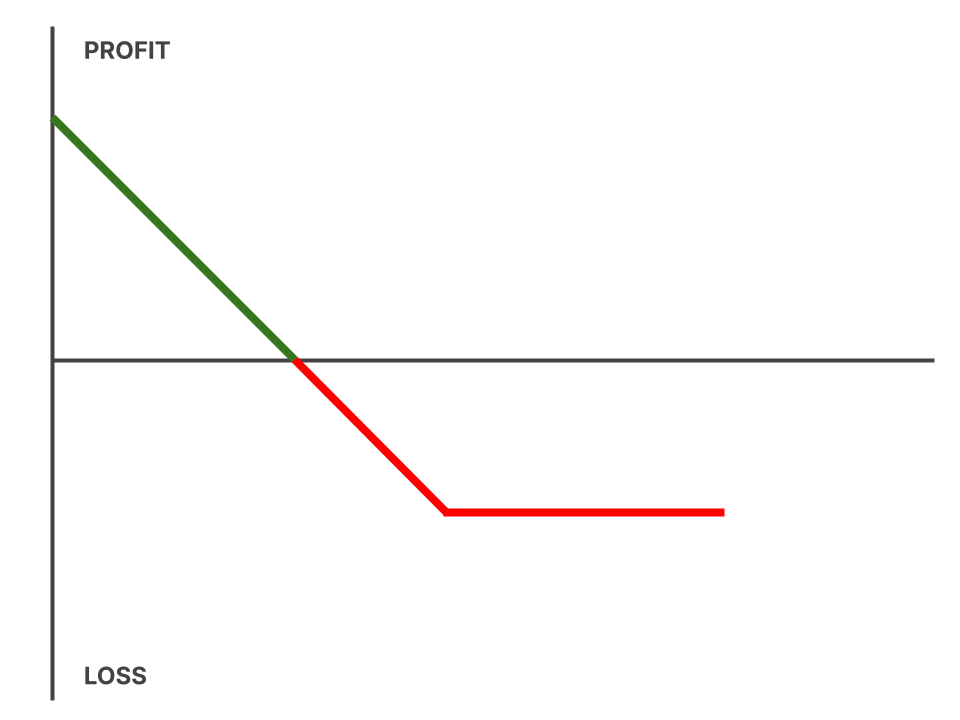

👉 Short Put

Under this type of Options Strategy Builder, the trader sells a put or “goes short” a put. The trader hopes for the stock price to rise above the strike price by expiration. When the trader sells a put, the trader gets a cash premium - short put. In case the stock becomes lower than the strike price at expiration, the trader needs to buy the same matching the strike price.

The short put upside is lesser than the premium and the maximum return is made when the seller receives upfront. The downside of a short put is the underlying stock value after deducting the premium, in case the stock becomes zero.

A short put is an ideal strategy if you think that the stock will close at the strike price or higher. The stock can match or remain higher than the strike price to expire at nil value. The trader can keep the premium. Best for long-term investors, who buy the asset at the strike price. They hope the stock falls to fall and get extra cash.

The short put upside is lesser than the premium and the maximum return is made when the seller receives upfront. The downside of a short put is the underlying stock value after deducting the premium, in case the stock becomes zero.

A short put is an ideal strategy if you think that the stock will close at the strike price or higher. The stock can match or remain higher than the strike price to expire at nil value. The trader can keep the premium. Best for long-term investors, who buy the asset at the strike price. They hope the stock falls to fall and get extra cash.